Integrated Treasury Management Solution Including Risk Management And Customer Foreign Exchange Transaction Management Solution

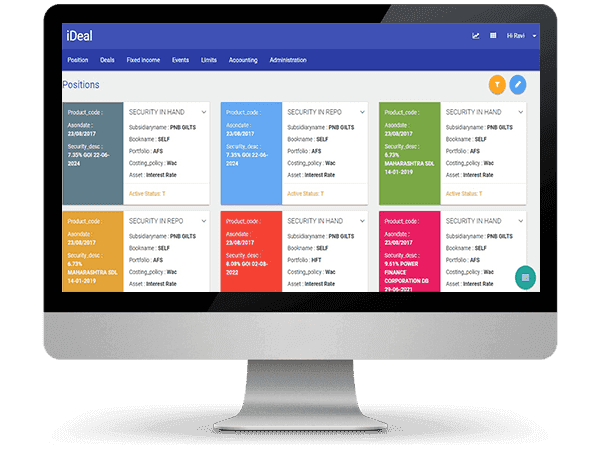

Credence iDEAL is an integrated STP treasury solution addressing the complete treasury management requirements of banks and financial institutions.

iDEAL covers a wide range of products including foreign exchange & money market, bonds & securities, derivatives, equities, mutual funds, securities lending, etc. iDEAL addresses the functionalities across the front office, mid office and back office of the treasury. Additionally, iDEAL also has extensive risk management capabilities built into the solution to help the bank track, assess and leverage the various strategies available.

iDEAL has a range of user-friendly and intuitive tools to assist the dealers, risk managers and operations team to run a very highly efficient and profitable treasury outfit with maximum scalability.

Features

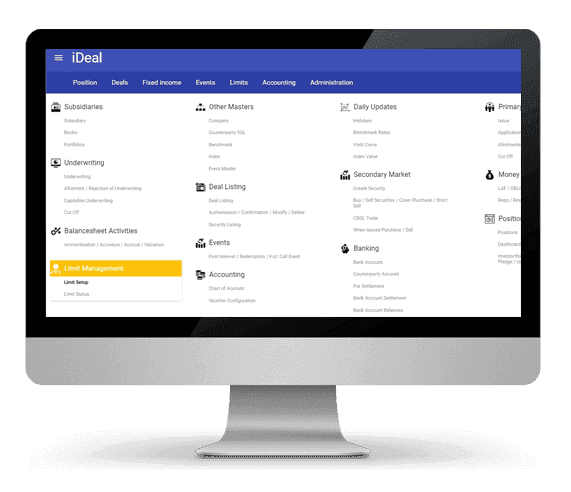

Integrated solution for RBU and FCBU

iDeal ITMS supports operations across both the RBU and FCB units of a bank for products ranging from money market instruments, repo, reverse repo, gilts and bonds, swaps, futures, equities, mutual funds to foreign exchange inter-bank and merchant products. Integrated exposure reports with domestic investments portfolios and forex holdings are available alongwith monitoring of integrated counterparty limits. A consolidated trial balance for both units can also be viewed at the end of the day.

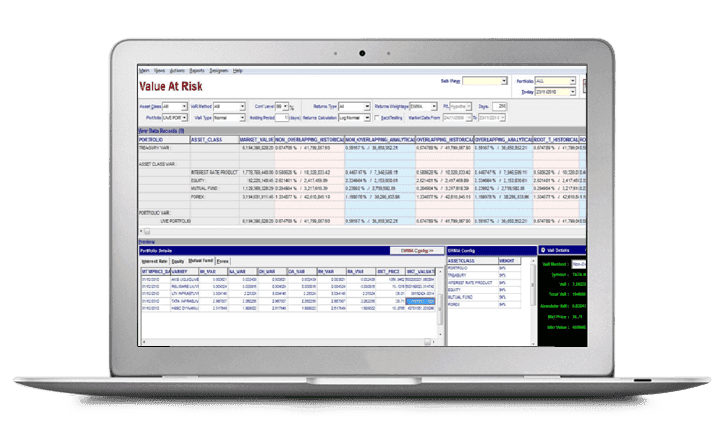

Risk Management

RiskMark is a powerful risk management tool that aids institutions in calculating capital charge calculations for market risk. It collates market risk factors from market data providers on a daily basis, integrates exposures across asset classes, uses complex statistical techniques for full portfolio valuation and value at risk (VaR) calculations. The solution also offers a comprehensive limit engine for monitoring investment exposures and counterparty exposures.

Decision Making Support

The solution provides decision enabling tools for making investment related decisions. Dealers can use the pre deal analysis module for ascertaining impact of deals on profitability, investment limits and portfolio duration. What If analysis available for evaluating the impact of parallel and non parallel shifts to the term structures of interest rates. A suite of off the shelf MIS reports can be used for cash flow forecasting, stop loss limit monitoring, turnover and profitability assessment.

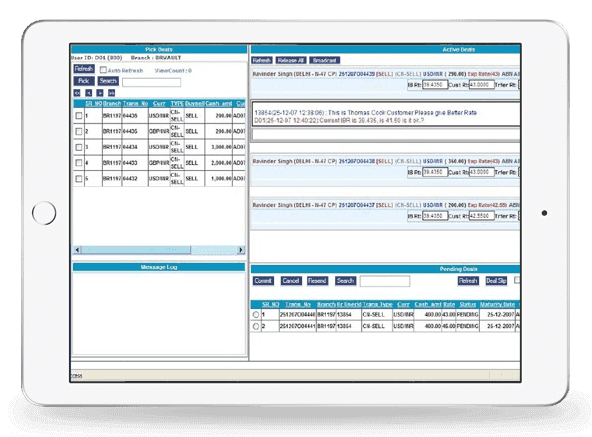

Customer foreign exchange transaction workflow management solution

The solution is integrated with a direct to customer dealing module that provides a direct channel for a bank's customers to obtain competitive FX quotes. Inward remittance module available for reconciling account debit / credits in SWIFT MT130 Statements with MT 940 Statements and further auto processing the deals based on standing instructions. The module also supports operations in Currency Notes, Outward TT, Travellers Cheques and Demand Drafts.

Reporting and Data Visualisation Tool

With the business intelligence tool, making business decisions is faster, easier, and more collaborative. The tool puts rapid analytics and an associative experience right on your desktop and gives you the ability to share your insights with others. The drag-and-drop feature makes integrating data from multiple sources easy. Users can create and view personalized, interactive data visualizations and dashboards inorder to make meaningful decisions.

Usage Across Industries

Regulatory and economic reforms, increasing cost of compliance, changing global economic perspectives and technology disruptions are transforming bank's trading and treasury functions today. This puts pressure on Banks to become more efficient and agile while exceeding the needs of their customers. Banks of all sizes are looking to drive true transformation so they can link human needs with banking offerings while leveraging investments in their existing core banking systems.

Over the last decade the office of the Corporate Treasurer has experienced significant changes that are re-defining the traditional frontiers as well as its position and influence within the organization. Key drivers for these changes include globalization and expansion of businesses into new and emerging markets, evolving role of the corporate treasury to being an advisor/strategic partner to the rest of the business, explosive growth in e-payment transactions and the drive towards real-time payments, increased adoption of technology and technology innovations, and stringent regulations. Global treasuries are, thus, increasingly looking for partners who can provide end-to-end business technology solutions to remain efficient, competitive and future-proof the dynamics of a volatile operating environment.