Multi-subsidiary, multi-currency and multi-asset class supporting solution

Managing Cash, Liquidity and Risk on a Single Unified Platform Over the last decade the office of the Corporate Treasurer has experienced significant changes that are re-defining the traditional frontiers as well as its position and influence within the organization. Key drivers for these changes include globalization and expansion of businesses into new and emerging markets, evolving role of the corporate treasury to being an advisor/strategic partner to the rest of the business, explosive growth in e-payment transactions and the drive towards real-time payments, increased adoption of technology and technology innovations, and stringent regulations. Global treasuries are, thus, increasingly looking for partners who can provide end-to-end business technology solutions to remain efficient, competitive and future-proof the dynamics of a volatile operating environment.

Features

Focus on non banking treasury requirements with multiple subsidiaries, portfolios and accounting books

CashTrea has been designed specifically for managing treasury operations of corporates and non banking financial corporations. Unlike general ERP solutions, the timelines and dependency on the IT team for implementation of the module is considerably reduced on account of off-the-shelf modules for most of the critical treasury functions. Automation of manual processes for MIS generation and accounting removes operational risks that arise from maintaining transaction data and MIS in spreadsheets.

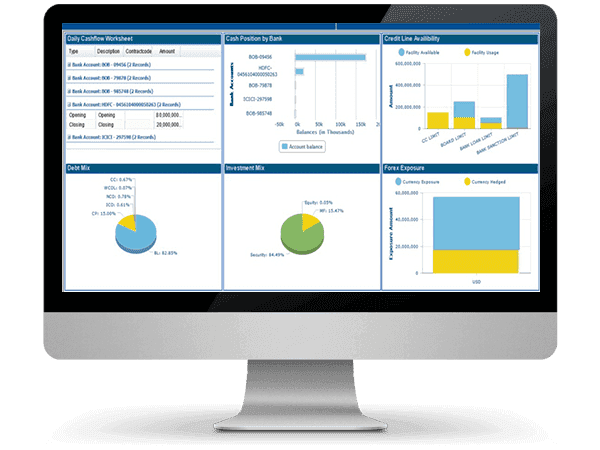

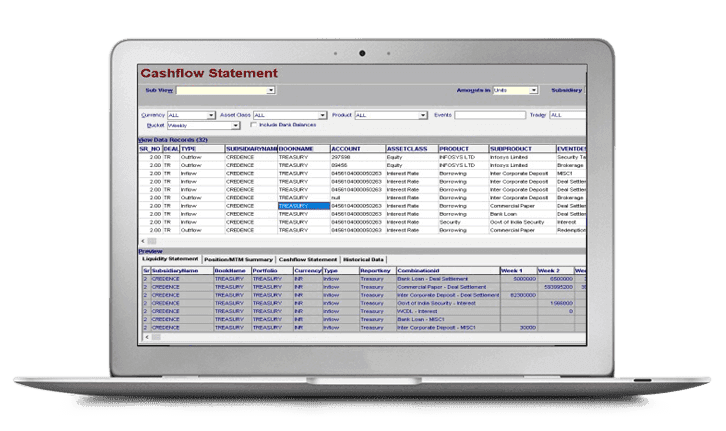

Cashflow Management

Cash flows that originate at different departments in the tiered set up of corporates / NBFCs need to be centrally available to the treasury to make funding and investment decisions. CashTrea allows collation of cash surplus / deficit information from different units to arrive at group level cash position. It keeps track of bank balances and fund transfers and provides a short term liquidity view based on the future commitments.

Investment Management

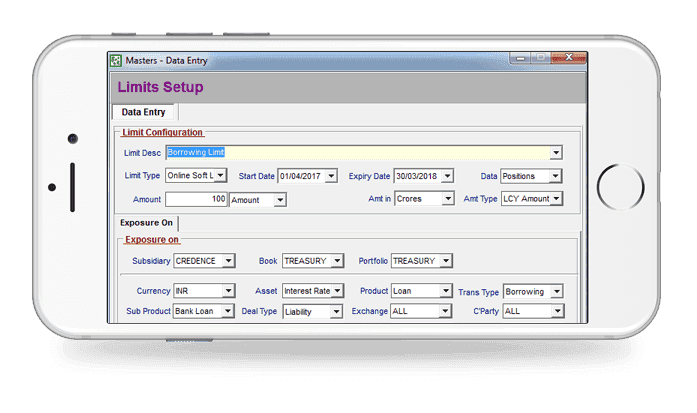

In case of surplus cash, decisions are taken to invest in asset classes that meet the short term and long term goals of the treasury. CashTrea supports the investment lifecycle in deposits (bank and inter-corporate), fixed income securities (treasury bills, government securities, commercial papers, corporate bonds) and mutual fund units. The solution aids in keeping track of performance measures like investment portfolio yield (IPY) as well as risk related limits.

Customer foreign exchange transaction workflow management solution

The solution is integrated with a direct to customer dealing module that provides a direct channel for a bank's customers to obtain competitive FX quotes. Inward remittance module available for reconciling account debit / credits in SWIFT MT130 Statements with MT 940 Statements and further auto processing the deals based on standing instructions. The module also supports operations in Currency Notes, Outward TT, Travellers Cheques and Demand Drafts.

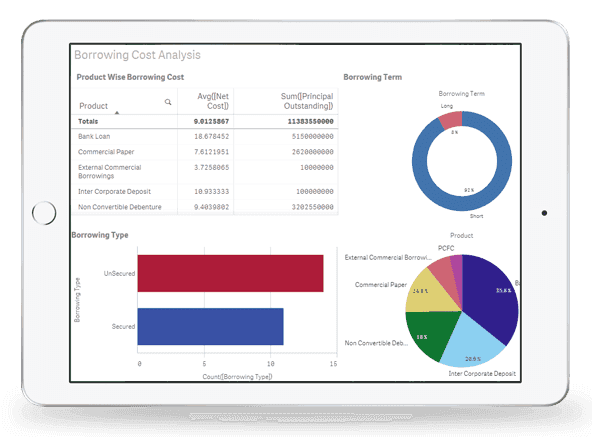

Funding / Borrowing via various Credit Lines

Treasuries manage borrowing / resourcing programs centrally to ensure lower cost of borrowing. CashTrea allows Treasuries to assess their funding requirements and shore up funds via issuance of commercial papers, corporate bonds with put / call options, step up coupons, redemption premiums etc. Alternatively borrowings can be recorded with differing interest and repayment structures, principal amortization schedules, multiple settlement conventions and settlement calendars.

Usage Across Industries

Over the last decade the office of the Corporate Treasurer has experienced significant changes that are re-defining the traditional frontiers as well as its position and influence within the organization. Key drivers for these changes include globalization and expansion of businesses into new and emerging markets, evolving role of the corporate treasury to being an advisor/strategic partner to the rest of the business, explosive growth in e-payment transactions and the drive towards real-time payments, increased adoption of technology and technology innovations, and stringent regulations. Global treasuries are, thus, increasingly looking for partners who can provide end-to-end business technology solutions to remain efficient, competitive and future-proof the dynamics of a volatile operating environment.